How To Unlock A LOT More Income In Retirement - Learn The Secret Your Advisor Isn't Telling You About...

Traditional Retirement Accounts (TRA's) VS Indexed Universal Life Insurance (IUL) - Myths Debunked & Hidden Truths Revealed

Hi, my name is Juan Walker, Florida Life Insurance Agent with Symmetry Financial Group. I want to share with you today the hush-hush, game-changing secret that could unlock a lot more income for you in retirement.

This is something your advisor isn't telling you about, and you deserve to know.

To accomplish this, I'm going to have to reveal some hidden truths, debunk some myths, and provide you with a detailed comparison between Traditional Retirement Accounts (TRA's) vs Indexed Universal Life Insurance (IUL).

I think you will find some of the math I've put together to be shocking, but also very informative and hopefully helpful for you and your family. I recommend to read until the end so you don't miss out on this extremely vital information.

There are experts in the world of finance who frown upon anything that isn't a term life insurance product, including Dave Ramsey.

Would you be shocked to know that Dave is the #1 seller of term life insurance in the country as a licensed insurance agent?

Obviously his recommendations are heard by the masses and followed by most people in the United States.

Why Dave Ramsey's Recommendations Work So Well

The main recommendation he makes is as follows:

Step 1: Get an inexpensive term life insurance policy in place to protect your family. Normally a 10-40 year term period.

Step 2: Take the rest of the money you have leftover each month and invest it into a retirement vehicle like a 401K, 403B, IRA, etc, tied to mutual funds that will grow and compound over time.

Simple, easy, set it and forget it type of investing that over 30-40 years can yield a small fortune. Well surprise, surprise, this advice actually works. I'm not here to argue that point.

In fact, I'm going to run the numbers on how well it does work very soon.

But the main reason it works is because inflation is always going up and stock market prices (like the rest of the economy) must also eventually follow suit and go up in price and value as well.

But I think we can both agree that there are some pros and cons to this type of wealth building strategy.

What's Not So Great About Traditional Retirement Accounts (TRA's)

I'm going to assume you know the pros already, but here are two major cons regarding TRA's that are glaring. The first negative is the dreaded word, taxes.

Did you know that with TRA's when you begin to withdraw against the principal in retirement, that you will be paying taxes on the amount you withdraw each year?

Most people think they won't have to pay taxes, but it is not always the case. You got the opportunity to defer the taxes, but now in retirement you still have to pay them each year, which eats into the net amount you will receive.

The only exception to this rule is if you have a "qualified" Roth retirement account, but as you will see below, it will still not provide as many benefits as an IUL does for you.

The second negative is you are also exposed to market downturns and crashes.

If you end up retiring and drawing upon your built up nest egg, the total amount you can withdraw will be lower because the total value of your account(s) will be less than it was before the drop in the market.

The Pros & Cons Of Indexed Universal Life Insurance (IUL)

We are going to be fair to TRA's, as I will provide you with both pros and cons of IUL's. I'll make this quick, so let's first start with the benefits.

1. Protects your family and can protect your income as well.

An IUL is life insurance (like term life), which automatically protects your family in case of your early death with a net death benefit. Unlike term life which can expire after the initial term period, an IUL runs for your entire lifetime as long as the premiums are paid up through age 65.

IUL's can also be structured with riders to protect your income in case of disability or critical illness during your working years. So if loss of income occurs for those reasons, you will be allowed to take a portion of your net death benefit to help with whatever needs are required for you and your family.

2. Protects you from market risk

An IUL provides you with an opportunity to tie your cash value to a market index like the S&P 500, so your money can experience gains from the stock market. However, the main benefit is you will not experience any market losses - even when the market crashes. More on this later.

3. Protects you from paying unnecessary taxes

Because an IUL is a life insurance product, the IRS classifies the money paid in as premiums and the growth that occurs to that cash value over time as tax-advantaged.

When you decide to pull out money in retirement, you would be taking that money in the form of a policy loan (which does not have to be re-paid), therefore making every withdraw you make each year tax-advantaged retirement income (meaning taxes are not due on those funds).

When you eventually pass away, any outstanding loans would be subtracted from the net death benefit before being disbursed to your beneficiaries on a tax-advantaged basis as well.

The main cons of IUL's are as follows:

1. There are no dividends paid out as with whole life policies.

2. A portion of the money you put in has to pay for the death benefit portion of your life insurance policy, so not all of your money goes towards cash value accumulation and growth.

3. And lastly, you only get to participate in a capped portion of the market growth each year.

For example, different insurance carriers have different cap rates, but some go as high as 12%. This means if the market goes up 20% for the year, you will only receive 12% gains of the growth for that year.

But on the other side, if the market goes down 15%, you will not experience any losses. So overall, it all equals out and your money is protected if you decide to retire during a market downturn or crash.

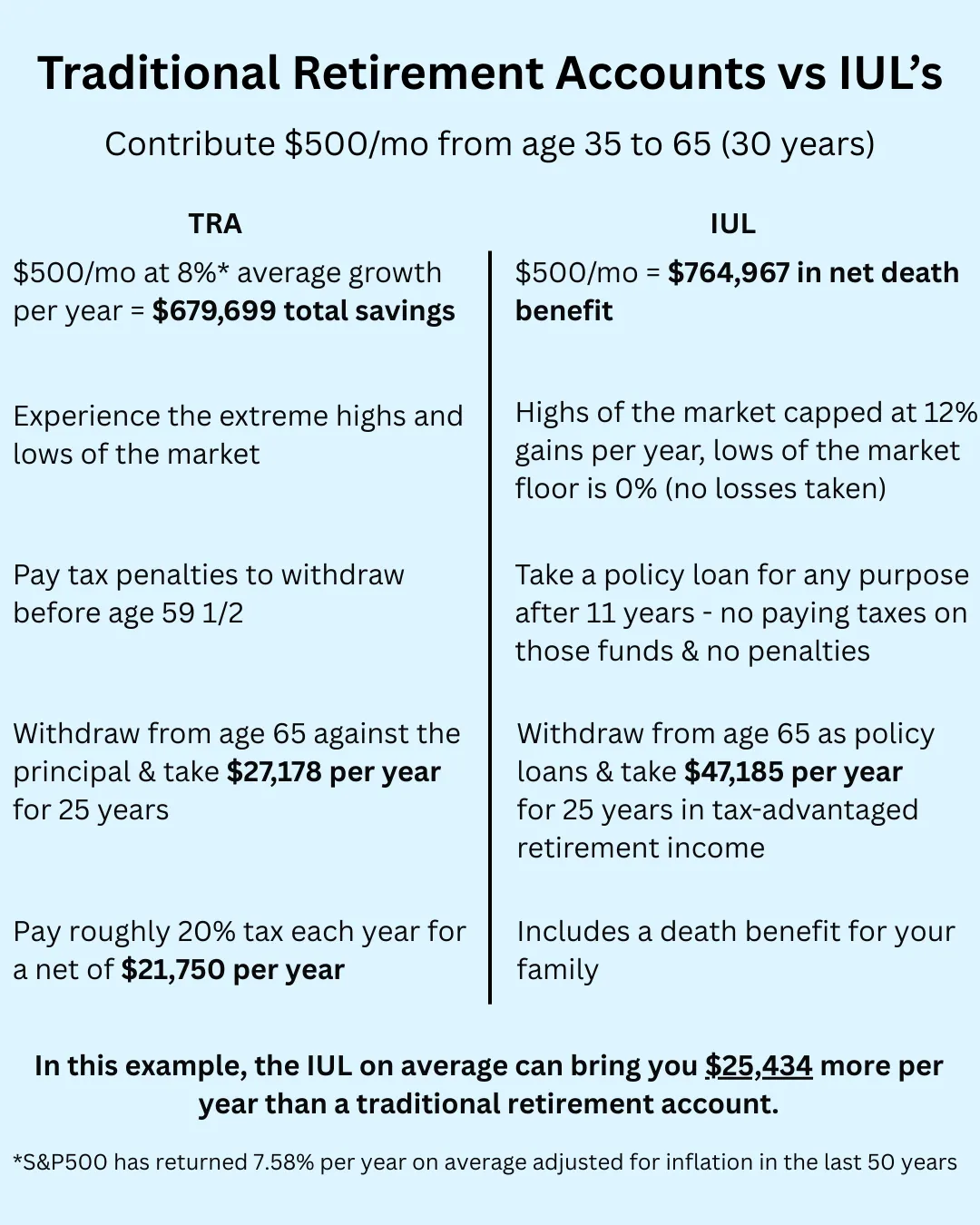

So now let's do a full comparison, running the numbers between Traditional Retirement Accounts vs an IUL. Here is an image with all of the math and information completed.

The Benefits Of An IUL Show Up In Your Net Retirement Withdrawal Number Each Year

As you can see from the example above, both a TRA and an IUL did a great job of growing the money tied to mutual funds or a market index, even with capped upside gains on the IUL side.

The biggest difference between the two is the additional flexibility afforded to IUL's, being classified by the IRS as life insurance and the tax-advantaged living benefits available that TRA's don't have.

In the example above, $500 per month was contributed or paid as premiums. As you can imagine, if the monthly number was bigger, the total amounts and yearly retirement withdrawal amounts would have also been bigger as well.

IUL's also give you the flexibility to increase or decrease payment amounts from year to year as needed, until you are fully paid up through age 65.

This includes repositioning with strategic rollouts from eligible retirement accounts, without paying taxes or penalties in the first 5 years.

So if you already have built a nice nest egg for yourself, a portion or all of it can be transferred into an IUL for even faster, greater growth, and protection of your money.

So Which One Is Better?

I have my biased opinion on it, but I would say they both work well at their intended purposes. I'll leave the final choice up to you.

I hope this free article has been educational and beneficial for you.

If you would like to get a free personalized illustration like the one you see above for yourself, along with a free quote on indexed universal life insurance, please click on the button below and fill out the survey on the next page.

You'll also gain access to a free video I've put together for you called, "3 Massive Mistakes To Avoid Most People Make When Setting Up An IUL ."

Click on the button below to access these now.

Sincerely,

Juan Walker, Licensed and Insured

Florida Life Insurance Agent

Symmetry Financial Group, LLC